The Definitive Guide to Arc Insurance Auto Insurance

According to the Insurance Policy Info Institute, the typical annual cost for an auto insurance plan in the USA in 2016 was $935. 80. Generally, a single head-on accident can cost thousands of dollars in losses, so having a plan will certainly cost less than paying for the crash. Insurance also helps you prevent the devaluation of your car.

Several variables influence the prices: Age of the automobile: Oftentimes, an older vehicle costs much less to insure compared to a more recent one. Make as well as model of automobile: Some cars cost more to guarantee than others.

The 7-Second Trick For Arc Insurance Cincinnati Oh

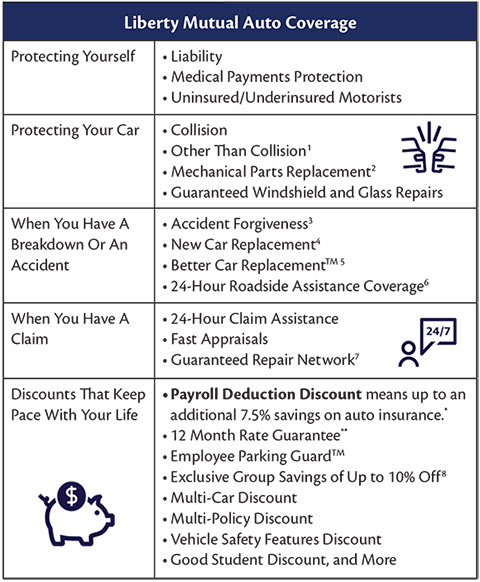

Risk of theft. Certain vehicles frequently make the regularly swiped checklists, so you might have to pay a greater premium if you have one of these. When it concerns automobile insurance coverage, the 3 main kinds of plans are obligation, collision, and also detailed. Compulsory responsibility protection pays for damage to one more chauffeur's vehicle.

Bike coverage: This is a policy particularly for motorbikes because car insurance doesn't cover bike mishaps (Car Insurance Cincinnati, OH). The advantages of automobile insurance policy much exceed the threats as you might finish up paying thousands of bucks out-of-pocket for a mishap you cause.

It's typically much better to have more insurance coverage than not sufficient.

Numerous classic automobile insurance providers also offer unique insurance coverages for points like showing your vehicle at auto shows, along with having proficiency in the repair of exotic automobiles. Nonetheless, utilizing classic automobile insurance policy might feature drawbacks, such as gas mileage limitations, as well as only specific cars and trucks are qualified for a vintage car insurance plan.

Our Motorcycle Insurance Cincinnati, Oh PDFs

This might be anywhere from $10,000 to $100,000 or even more it's all depending on what your classic automobile deserves, as identified by an evaluator. This is in contrast to the way regular cars are insured. If you have a frequently offered auto, your insurer will identify its worth based upon comparable models as well as the expense to fix it.

The various other major benefit of classic auto insurance is that these you can try this out companies specialize in dealing with unusual, enthusiast or antique vehicles. The representatives, adjusters and also other personnel you'll interact with when you have a traditional auto policy will recognize with the ins and outs of a rare automobile, and also a lot more experienced concerning the requirements of a vintage car owner.

Including hauling only with a flatbed tow truck to avoid deterioration while carrying to a service center or back residence. In situation a person receives an injury at an exhibit or event including your car. Supplies protection while you are far from your lorry as it is being presented, such as at an auto program.

Vintage car insurance policy isn't designed for autos you make use of every day or common automobiles like a current Toyota or Volkswagen (Arc Insurance Cincinnati OH). Classic automobile insurance companies normally need that there's something unique concerning the car, such as advanced age, high value or some modification. Generally, your car has to come under at the very least one of the adhering to classifications: A minimum of 25 years of ages Modern muscle mass car Unique Modified lorry It's additionally likely that your vehicle will certainly require to meet every one of the following needs in order to certify: In great condition Parked in a protected and fully confined garage, carport, storage facility or other authorized framework Not made use of for everyday commuting Not utilized for competing Driven no more than 7,500 miles per year (varies by insurer) Furthermore, there are generally qualifications that you, the proprietor of the vehicle, should satisfy.

Getting My Boat Insurance Cincinnati, Oh To Work

While a lot of collectible auto insurance plan are fairly comparable, the way service providers categorize various kinds of collectible automobiles, consisting of some kinds they omit Look At This coverage for, is essential to understand. Interpretations, years as well as descriptions can vary from insurance provider to insurance company and also state to state, the most common collectible vehicle classifications are listed below.

Specified by numerous firms as being 19 to 24 years of ages, brought back, in excellent functioning problem as well as greater than the ordinary value of various other cars of the very same year; some insurance firms consider an automobile of this summary that is just above 10 years old to be "classic." The Classic Automobile Club of America concerns classic vehicles to be those produced between 1925 as well as 1948 (Arc Insurance Cincinnati OH).